New Structures and Buildings Allowance

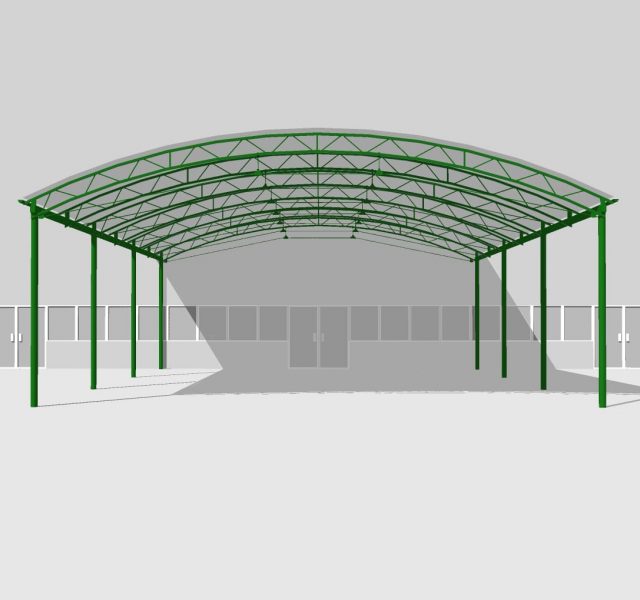

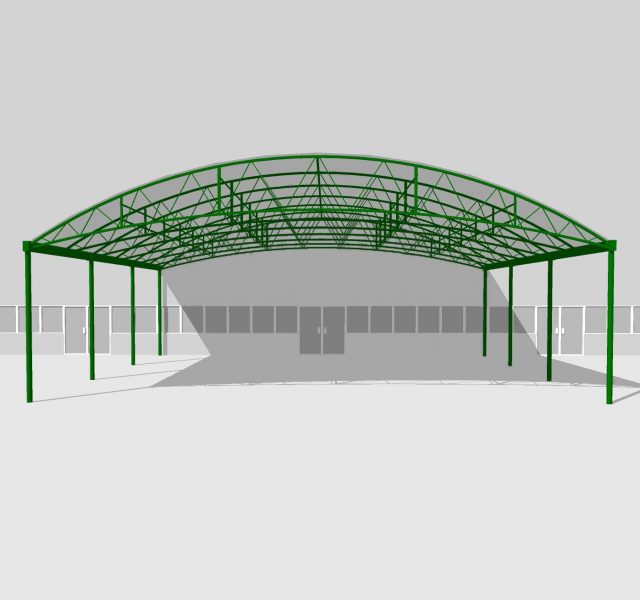

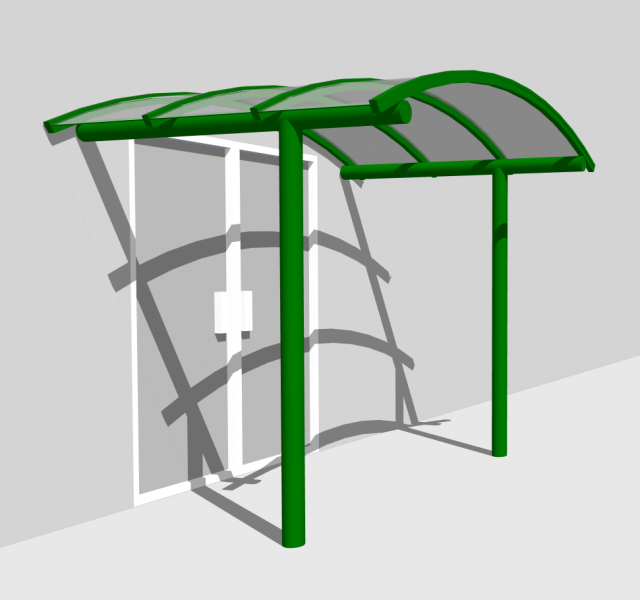

In the 2018 Budget the new capital allowance, the Structures and Buildings Allowance (SBA), which will give relief for expenditure on certain structures and buildings such as some of our canopies and walkways.

Key features of the SBA

- relief will be given at a flat rate of two percent over a 50-year period

- relief will be available for new commercial structures and buildings, including costs for new conversions or renovations

- relief is available for UK and overseas structures and buildings, where the business is within the charge to UK tax

- relief will be limited to the costs of physically constructing the structure or building, including costs of demolition or land alterations necessary for construction, and direct costs required to bring the asset into existence

- relief is available for eligible expenditure incurred where all the contracts for the physical construction works were entered into on or after 29 October 2018

- claims can only be made from when a structure or building first comes into use

- land costs or rights over land will not be eligible for relief, nor will the costs of obtaining planning permission

- the claimant must have an interest in the land on which the structure or building is constructed

- dwelling houses will not qualify, nor any part of a building used as a dwelling where the remainder of the building is commercial

- sale of the asset will not result in a balancing adjustment – instead, the purchaser takes over the remainder of the allowances written down over the remaining part of the 50-year period

- expenditure on integral features and fittings of a structure or building that are currently allowable as expenditure on plant and machinery, will continue to qualify for writing down allowances for plant and machinery including the Annual Investment Allowance (AIA) up to its annual limit

- SBA expenditure will not qualify for the AIA

- where a structure or building is renovated or converted so that it becomes a qualifying asset, the expenditure will qualify for a separate two percent relief over the next 50 years.

more information is available from the HMRC website